Options to suit your financial needs.

From personal and business checking accounts, to savings accounts, IRAs, CDs and more, our account options are tailored to fit your needs.

How are we doing?

Serving our community for generations.

At First Bank, you will find more than a century of continuous service and a strong history of putting our customers and our community first.

Midwestern State University Job Fair

Diana Gwin, Human Resources Director, represented First Bank at the job fair hosted by Midwestern State University. Our primary focus was on recruiting prospective employees, specifically individuals majoring in accountancy and finance. Banking is a wonderful career choice and First Bank would be honored to employ our local graduates.

A Field Trip to the Bank: Coder Elementary

Our Aledo branch recently hosted the Coder Elementary 1st graders for a field trip all about money and banking. This has been a tradition for First Bank and Coder Elementary since the branch was opened. The students were taken on a full tour of the bank, including the safe deposit boxes, teller line, and the infamous vault, then enjoyed a hot dog lunch on the patio. Each first grader left with a coloring book and a piggy bank with fifty cents in it to encourage them to start saving!

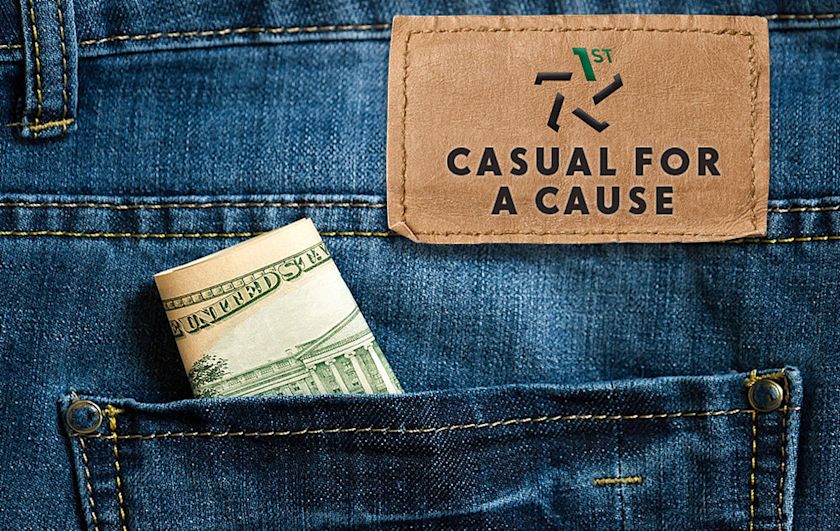

Casual for a Cause: Humane Society of Wichita County

Our charity for Casual for a Cause in February was the Humane Society of Wichita County. First Bank employees donated to support their mission of providing food, shelter, medical care and affection to homeless, abused and abandoned animals until they can find their forever homes.